Medical cannabis will be celebrating its sixth birthday in Britain later this year, but did you know that ever since 2016, the UK has persistently ranked as the world's largest cannabis exporter?

Although it was illegal for citizens to possess or cultivate cannabis for any purpose under the 1971 Misuse of Drugs Act, it has been reported that 95 tonnes of cannabis were legally grown and harvested by pharmaceutical companies on British soil to be exported around the world in 2016. Five years later in 20 21, production rates were estimated to have risen to around 59 hectares, or 329 tonnes, over two-thirds of which was internationally exported.

So, how much cannabis does the UK export? Let’s dive into the legal landscape, global cannabis exports, and the important role our small island holds in global medical cannabis markets.

The UK’s cannabis export market and legal landscape

In 1998 GW Pharmaceuticals became the first company to successfully secure a licence from the Home Office and the Medicines and Health Regulatory Agency (MHRA), giving them permission to cultivate cannabis to investigate the plant's potential medicinal value. At the time, cannabis was still strictly illegal in the UK, but by 2003 GW Pharmaceuticals had permission to produce Sativex - a cannabis-based drug designed to treat spasticity in patients with multiple sclerosis.

Regulatory hurdles and slow progress

Despite being pioneers in the UK, GW Pharmaceuticals faced many hurdles on its journey to make Sativex available to patients. Due to the legal status of cannabis in the UK, the biotech company was unable to market in the same country it had been produced, so they turned to international markets, bringing Britain into the cannabis export industry. By 2011, GW Pharmaceuticals were producing around 20 tonnes of cannabis every year. By 2016, Sativex had been approved in 28 different countries, and GW Pharmaceuticals was estimated to be worth over £1.35 billion.

During 2017 and 2018, advocacy groups, politicians, and international experts appealed to the British government to reconsider their stance on medical cannabis, captivating the mass media. In 2018, it was revealed that Theresa May, who at the time was serving as the British Prime Minister, may have financially benefited from the regulation of cannabis as her husband was a major shareholder in GW Pharmaceuticals – now known as Jazz Pharmaceuticals.

The irony of UK’s medical cannabis policies before 2018

Around six months before the legalisation of medical cannabis, Transform’s Senior Policy Analyst Steve Rolles highlighted the hypocrisy in this, saying:

“It is scandalous and untenable for the UK government to maintain that cannabis has no medical uses, at the same time as licensing the world’s biggest government-approved medical cannabis production and export market”.

In June 2018, British Home Secretary Savid Javid announced that the government would review the scheduling of cannabis-related medicines and in November 2018, following recommendations from their Chief Medical Advisor, Dame Sally Davies, the British Government announced the legalisation of medical cannabis.

How much cannabis does the UK export and import?

Each year, the International Narcotics Control Board (INCB) conducts a report detailing the international availability of controlled substances in countries all over the world. According to their data, the United Kingdom was the largest producer of cannabis in the world, producing over 329 tonnes in 2021 alone.

How much cannabis does the UK export and import?

Cultivation and production of cannabis in the United Kingdom from 2017-2021

| 2017 |

37.9 hectares

|

258.4 tonnes

|

| 2018 |

21 hectares

|

217.2 tonnes

|

| 2019 |

34.5 hectares

|

350.3 tonnes

|

| 2020 |

33.8 hectares

|

238.6 tonnes

|

| 2021 |

58.9 hectares

|

329.1 tonnes

|

During 2020 it is believed that a total of 650.8 tonnes of medicinal cannabis was grown around the world, of which the largest proportion (36%) was produced in the United Kingdom. Canada secured the second spot, producing around 227.8 tonnes in 2020, whilst the Netherlands is only reported to have produced around 6 tonnes.

In 2021, the UK continued to dominate the market and produced 43% of the cannabis that had been declared to the INCB, followed by Italy and Israel, responsible for 19.7% and 11.7% of all global medicinal cannabis production respectively.

Despite extensive cultivation on British soil, according to The UK Cannabis Report in 2019, all the cannabis-based medicines available to eligible patients in the UK had been imported from abroad. The report explains that this is because the licences approved for cannabis production in the UK ensure that the harvested plant is used in the production of licensed pharmaceuticals such as Sativex, as opposed to unlicensed forms of medical cannabis such as flowers, and so over two-thirds of the cannabis produced in 2021 was exported abroad.

In the 2023 European Cannabis Report, also conducted by Prohibition Partners, it was found that although 35.1% of cannabis extracts available in the United Kingdom were formulated or manufactured into products within the UK, the majority of these extracts were cultivated in countries like Denmark (19.6%), North Macedonia (17.5%), Australia (15.5%), and Portugal (12.4%).

Impact of the UK cannabis industry nationally

The flourishing UK cannabis export industry has the potential to make waves in domestic cannabis production and beyond.

Job creation and economic growth

Further growth in the medical cannabis export market will lead to the creation of a huge range of jobs and foster the growth of a new sector within the UK economy. From cultivation to distribution, research and development, and even insurance and legal services, the cannabis industry has the potential to be a significant supporter of employment in the UK that contributes to the country's economic vibrancy.

Opportunities for UK farmers and producers

The newfound opportunities also extend to UK farmers and cannabis producers. With the right support and incentives, these stakeholders can benefit from the up tick in demand, turning what was once an underground commodity into a legitimate and lucrative agricultural product.

Potential for research and development

The boost in economic activity could fuel greater investment in cannabis research and development. The UK's strengths in scientific research could be harnessed to innovate in medical applications, leading to breakthroughs in cannabis-based treatments and therapies

Future Outlook and Opportunities

Looking ahead, the future of the UK's medical cannabis export market is brimming with potential.

Potential for growth in the global medical cannabis market

Global demand for medical cannabis is on an ever-increasing upward trajectory, with a projected CAGR that indicates significant growth potential. The UK's commitment to quality and innovation positions it favourably for a slice of this thriving market.

UK's position in the international market

The success of the UK's medical cannabis export market will determine its place in the international trade arena. By establishing a reputation for reliability, integrity, and superior products, the UK can become a key exporter in the rapidly expanding medical cannabis domain.

FAQs on the UK medical cannabis export sector

What sparked the UK's involvement in the medical cannabis export market?

The UK's involvement in the medical cannabis export market was largely influenced by GW Pharmaceuticals' success in obtaining a licence to cultivate cannabis for medicinal research in 1998. This paved the way for the UK to become a key player in the global cannabis export industry

How has the UK's legal landscape affected its cannabis export?

Despite the legal restrictions on cannabis within the UK, the country has emerged as a leading cannabis exporter due to pharmaceutical companies legally growing and exporting cannabis. The legalisation of medical cannabis in 2018 further impacted this, though the majority of produced cannabis is still exported.

What are the future prospects for the UK's medical cannabis industry?

The future looks promising for the UK's medical cannabis industry. With its commitment to quality and innovation, and the global demand for medical cannabis rising, the UK is well-positioned to expand its role in the international market.

Conclusion

Although the UK is one of the largest producers of medical cannabis in the UK, due to strict industry regulations and a lack of standards amongst unlicensed cannabis products in the UK manufacturing, the majority of its cultivated cannabis is sold to the international market and exported abroad, an operation style industry experts have described as 'an anomaly’.

Either way, medical cannabis is here in the UK, and it is here to stay. Medical cannabis is showing huge potential in treating a variety of conditions, and it looks like the UK is ready to take on its rightful place amongst established medical cannabis markets.

From production licences and export regulations, to domestic access points and product availability, the UK’s approach to medical cannabis is ever-evolving and so too are its players - with new companies entering the market all the time.

As the UK sets out on its journey to establishing a multi-billion pound medical cannabis industry, one thing is clear: the future for medical cannabis in the UK looks promising.

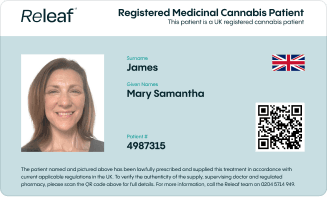

Releaf understands that medical cannabis can be life-changing for many people. That's why we offer tailored monthly packages based on your cannabis prescription, specialist consultations for medical cannabis, and a unique medical cannabis card for protection.